[ad_1]

Regardless of whether you are a salaried employee, a business owner, or a student, a secure and easy-to-use financial platform is crucial. Using Money Network’s Activate Card, a leading financial services provider, addresses this need seamlessly. However, this article will help you know how Moneynetwork.com Activate Card Login empowers users to get in control of their finances.

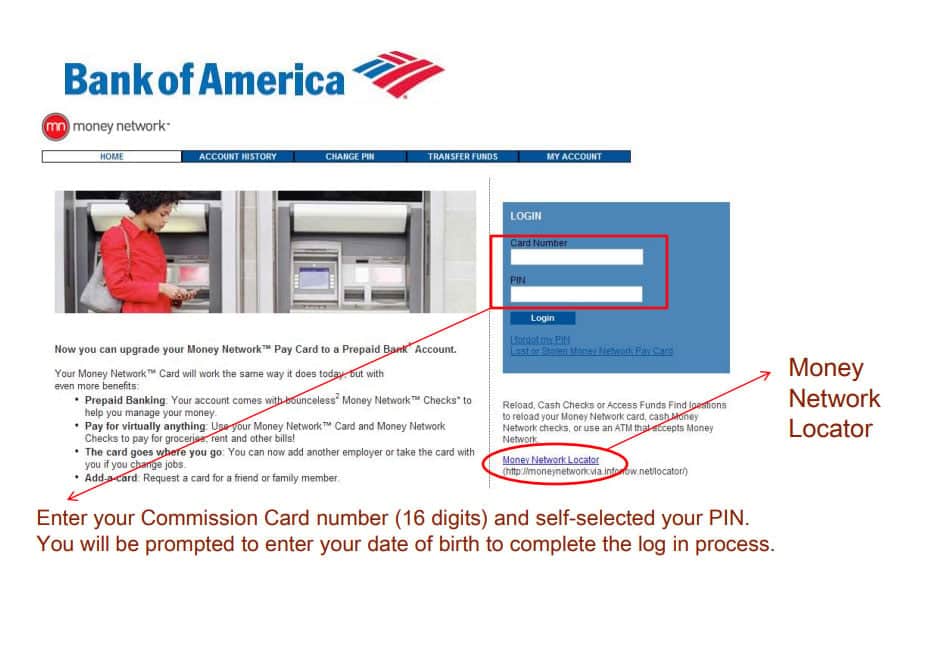

How do I Activate my Money Network Debit Card?

- You can reach us at 1.800.240.8100. To activate, you will need your Card Number, the last six digits of your social security number, and the three-digit security code found on the back.

- Your name and address, as well as answering identity verification questions, could be required to verify your identity.

- Your balance will also be displayed, along with your 4-digit PIN required for ATM transactions.

- Use a PIN that does not contain personal information for the security of your account

- Only the primary Cardholder (listed first on the Card) may activate Cards with more than one name.

What is the process for Transferring Funds from my EIP Card to my Bank Account?

A variety of methods exist to transfer funds from your EIP Card to an existing bank account. You will need your bank account’s Routing and Account number to complete the transfer.

Funds can be transferred online at EIPCard.com

- Before transferring funds, ensure that your EIP Card has been activated.

- To register for online access, go to EIPCard.com and click on “Login” or “Register Now.” You will need to create a User ID and a Password by following the instructions. Make sure to have your EIP card with you.

- Under Money Out, select “Transfers in the U.S.”

- Make sure your destination bank account is set up before completing your ACH transfer.

- It should take 2-3 business days for the transfer to appear in your bank account.

Transfer funds using the Money Network Mobile App

- Ensure your EIP Card has been activated before making a transfer.

- You can register for mobile access by downloading Money Network Mobile App2 and clicking “New User? ”. Once you have created your User ID and Password, follow the steps below. Make sure you have your EIP card on hand.

- Under Move Money Out, click “Send Money to an External Bank Account” in the top left menu.

- To complete your ACH transfer, you will need to set up your destination bank account.

- In 2-3 business days, your bank account should reflect the transfer.

Call 1.800.240.8100 to transfer funds

- Before transferring funds, make sure your EIP Card has been activated.

- You will be prompted to authenticate with the Interactive Voice Response Unit (IVRU) when you call 1.800.240.8100.

- To complete your ACH transfer, follow the prompts to set up your destination bank account after the IVRU has authenticated you.

- It should take 2-3 business days for transfers to appear in your bank account.

What Are The Benefits of Having a Moneynetwork Card?

They offer a range of benefits with their prepaid debit card, known as the Money Network Card:

- Convenience: You don’t need to carry cash or checks with a Money Network Card. Like a traditional bank debit card, you can use it for purchases, payments, and withdrawals from ATMs.

- Spending management: The Money Network Card makes it easy to manage your Money. The tool helps individuals stay financially disciplined by allowing them to budget and control expenses.

- Direct Deposit: Direct deposit of your salary onto your Money Network Card is offered by many employers. It gives you quick and secure access to your Money.

- No Credit Check: Money Network Cards do not require credit checks. Consequently, it can be used by individuals from a variety of financial backgrounds.

- Security: Your funds are protected by advanced security measures at Money Network. It is possible to report a lost or stolen Card and have it replaced with the remaining balance.

How to Manage Your Money Network Card in 2024

As soon as you have activated and explored your Money Network Card, let’s talk about how to manage it effectively:

1. Budgeting

Make and stick to a budget with your Money Network Card. Keep track of your spending through your account’s transaction history, and set limits to stay on budget.

2. Security

You should protect the information associated with your Money Network Card. Be careful when using ATMs to avoid skimming devices, and never share your PIN.

3. Regularly Check Balances

Keep track of your card balance frequently to avoid overdrafts, and make sure you have sufficient funds to make purchases.

4. Notifications

For account updates and card activity notifications, enable account notifications. If there are any unauthorized transactions, you will be able to identify them quickly.

5. Reporting Lost or Stolen Cards

To prevent unauthorized use of your Money Network Card, report it immediately if it is lost or stolen. Replacement cards can be ordered from Money Network’s customer service department.

6. Using ATMs Wisely

Avoid additional fees by using Money Network’s in-network ATMs when withdrawing cash. Your account or mobile app will provide a list of in-network ATMs.

From Author’s Desk

So, that’s all we have for you on activating the Money Network Activate Card. It’s our hope that you find this article helpful. Meanwhile, we will be happy to help you further if you have any doubts or queries.

ALSO READ:

[ad_2]

Source link